COVID-19 has touched people’s lives in ways that nothing has before. Recently, hundreds of thousands of people began their trading journey during the pandemic for the very first time. Without knowing what you are getting into, the chances of losing or breaking even are high; this is why we recommend that you educate yourself in the field before beginning your funded journey. 8FigureTrader (8FT) takes great pride in helping facilitate ways for funded traders to get into the game. One of the best ways to magnify your staying power and establish a profitable and sustainable long-term plan is to invest in several areas of the market. Using different strategies may minimize the chances of one drop affecting your portfolio as a whole.

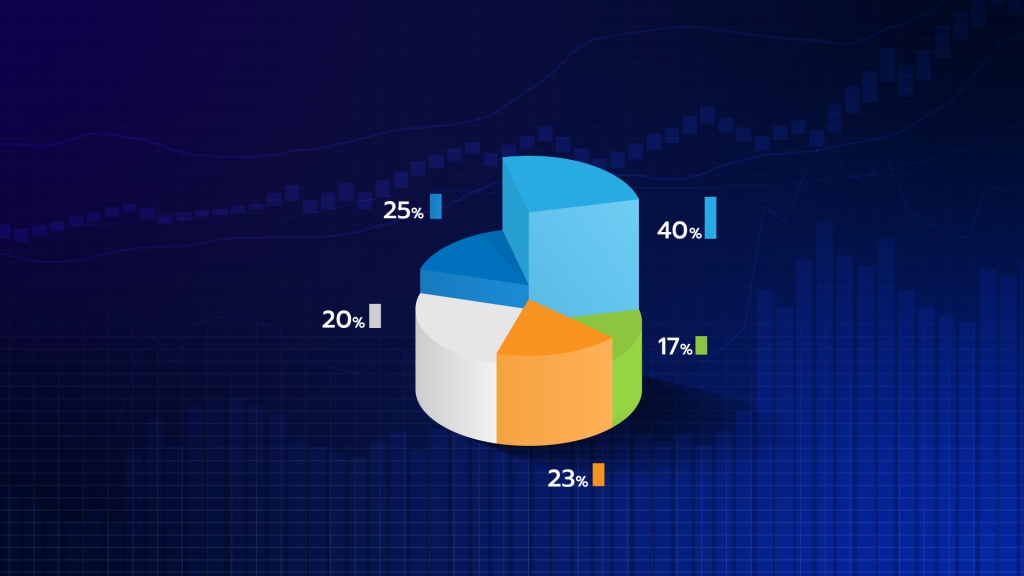

There is a saying that we all are aware of that goes something like, “don’t put all your eggs in one basket.” If a trader spreads his or her investments across different assets that are ultimately influenced by different factors, he or she may decrease chances of exposure to “unsystematic risk,” which in other words, means that the trader won’t risk it all if something goes downhill with one investment. By nature of the way trading works, it is highly unlikely that you can avoid all risks, but there are strategies that you can have in place that will minimize the risk of losing it all, which will then in turn increase the chances of winning into the future. Additionally, having a diverse forex portfolio will give you an opportunity to experiment with trades, improving the chances of coming across favorable outcomes and making a profit.

There are many ways to diversify your trading. One of the ways is to use a mix of currency pairs. Doing this will enable you to diversify the ways in which you spread risk using different currency pairs with various levels of risks attached; this will then in turn give you the opportunity to save yourself from major losses. For example, you could use a base of major currency pairs that are less volatile, such as GBP/USD, AUD/USD, or EUR/USD. In addition to that, you could then add some minor unique pairs, such as EUR/TRY. The unique pair is more volatile and creates a sizeable opportunity for large profits. However, it is important to note that unique currency pairs like the aforementioned also mean there are bigger opportunities for large losses.

Another way to diversify your trading portfolio is to learn different strategies. Mixing up strategies will give you a sense of the strategies that are the most beneficial for you and the ones that generate the most returns.

Lastly, experiment with trading times. Depending on the time and day, currencies perform differently. It is important, if not crucial, to monitor the ways in which currencies function depending on the time. Doing so can provide you with new opportunities. Of course, you will always have to consider the risks involved.

Diversifying your portfolio will give you an extended opportunity to tip the odds in your favor, bringing in more profit than bring about losses. The better you get at this with time, the more you will learn how to diversify your portfolio and make more money (and minimize losses).