At the beginning of a new candle, there is often a few minutes wherein price don’t seem to move much. This is because many astute traders know that as a candle forms, other traders would make decisions based on the type of candle that was formed. No one would know what would happen next. Price may either continue the direction of the previous candle, or it may reverse. This few minutes window of indecision by the market is called consolidation.

Many scalpers in slower moving markets use the Depth of Market window or what others call Level 2 order flows to get a feel for where the market might be heading next. However, I seldom find traders who use Depth of Market in forex trading. There may be several reasons for this. For one, there are very few trading platforms that give the complete picture of pending orders based on the Level 2. Another reason might be because of the sheer size and volume of transactions in the forex market, pending orders on both sides are too big, information regarding the pending order’s volume move so fast, it humans couldn’t cope with the speed. Sadly, I think we don’t have a way to assess the direction using the consolidation phase every candle open.

But all is not lost. What we can do however is trade ignored consolidations. There are times when the market seems to skip the consolidation phase every candle opening and continue the direction of the previous candle. This is called momentum.

Momentum plays is one of the most common types of strategies, with varying approaches and styles. The idea behind this is that the force behind the previous candle is so strong, the market would just push through with its current direction.

With this strategy, we will be trading candles that we believe have momentum and that the next candle would ignore consolidation.

To do this, we will be using 7 & 14 Simple Moving Averages (SMA). We will also be targeting only five (5) pips. If the candle really does have momentum, a 5-pip target would be easy.

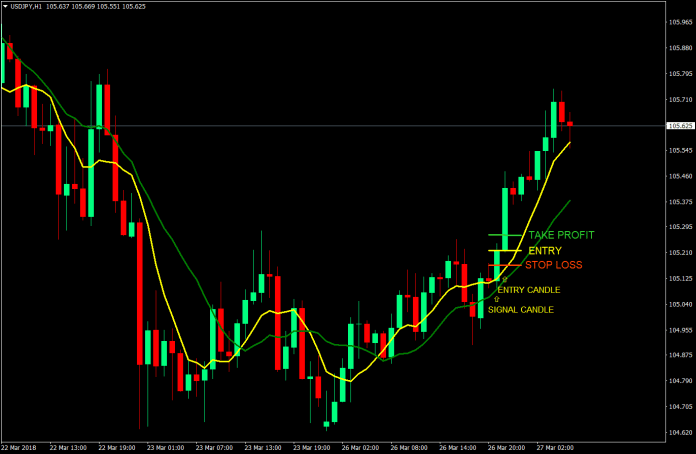

The Setup: Trading Momentum Using 7 & 14 SMA

Although this is a scalping strategy, we will still be using the 1-hour timeframe. This is because more traders are looking at the hourly candles as compared to the lower timeframes. If the previous hour does have momentum, traders looking at the candle on the next hour would immediately enter based on candle patterns without waiting on the consolidation phase. This volume of traders would push momentum further.

The rules of this strategy will be based on how a candle opens and closes in relation to the 7 & 14 SMAs.

Buy Setup:

- The 7 SMA should be above the 14 SMA.

- On the signal candle price should open in between the 7 SMA and the 14 SMA.

- On the same candle price should close above the 7 SMA.

- There should only be a little to no wick above the signal candle.

- The low of the candle should not go below the 14 SMA.

- Enter immediately at the open of the next candle.

Stop Loss: Stop loss should be 5 pips below the entry price.

Take Profit: Target take profit price should be 5 pips from entry price.