VWAP Pullback Strategy: Trading Institutional Value Instead of Guesswork

Published January 16, 2026 · 8FigureTrader Editorial

Intraday markets move fast, and most traders lose money for the same reason: they chase price after the move is already over. The VWAP pullback strategy flips that behavior on its head by anchoring decisions to volume-based value instead of emotion.

What VWAP Really Represents

VWAP (Volume Weighted Average Price) measures the average traded price of an instrument while weighting each transaction by volume. Unlike moving averages, VWAP highlights where real participation has occurred, making it a preferred tool among professional traders.

- Dynamic intraday support and resistance

- Fair-value execution benchmark

- Session directional bias framework

The Logic Behind the VWAP Pullback Strategy

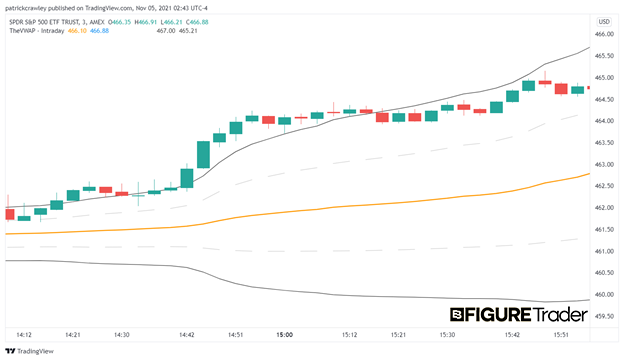

The VWAP pullback strategy focuses on entering after momentum has already been confirmed. Traders wait for price to extend away from VWAP, then pull back toward fair value before joining the trend.

Trade Examples

Long Setup: Expansion above VWAP deviation → pullback to VWAP → continuation higher.

Short Setup: Breakdown below VWAP deviation → pullback to VWAP → continuation lower.

Risk Management and Targets

- Stop Loss: Just beyond the VWAP line

- Targets: VWAP deviation bands or trailing stops

When This Strategy Performs Best

This strategy excels during high-volume sessions with clear directional intent, particularly during London and New York market hours.

Final Thoughts

The VWAP pullback strategy removes guesswork by aligning entries with institutional value zones. It offers structure, clarity, and repeatability—exactly what most traders are missing.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Trading involves risk.