Given that consumer spending slowed more than anticipated in January and price pressures remained sticky, new statistics may indicate a growing conflict between the US Federal Reserve’s twin inflation and employment targets. Traders continued to place bets that the Fed will lower interest rates by a quarter of a percentage point during this year’s June and September meetings, but analysts pointed out that the situation appeared to have grown more complicated and would force policymakers to make a tough choice in the coming weeks. It “presents a dilemma for the Fed…if you mix them together, that equals stagflation,” according to Peter Cardillo, chief market economist at Spartan Capital Securities in New York, who noted that signs of slowing GDP and inflation that is still above the Fed’s 2% target. “There is a lot of anxiety for the Fed currently.” Stagflation is the term used to describe the combination of high inflation and poor growth that may require policymakers to decide between tightening monetary policy to guarantee that inflation returns to target or reducing rates further, at the margin, to promote economic growth and jobs. This week, policymakers started to raise that prospect.

In January, PCE inflation increased 2.5% annually, in line with projections.

While consumer spending unexpectedly shrank in January, U.S. inflation matched the pace of the previous month and slowed on an annualized basis, giving Federal Reserve policymakers a confused economic picture when deciding how to proceed with interest rate policy. The Bureau of Economic Analysis at the Commerce Department released statistics on Friday that showed a 0.3% increase in the Personal Consumption Expenditures (PCE) Price Index last month. The number was consistent with the pace of December, which saw the biggest growth since April 2024. PCE inflation decreased little from 2.6% to 2.5% in the 12 months ending in January, which was in line with economists’ projections. When food and energy are taken out of the equation, so-called core PCE inflation dropped from 2.9% in December to 2.6% year-over-year, which was in line with forecasts. The gauge’s initial value in December was 2.8%. Core PCE met expectations as well, increasing slightly from 0.2% to 0.3% on a monthly basis. After an upwardly revised 0.8% gain in December, consumer spending—which makes up a significant portion of the U.S. economy—dropped by 0.2%. The number had increased by 0.2%, according to analysts.

Early trading saw a little increase in the S&P 500 after the release of a crucial inflation indicator.

Early Friday trading saw a rise in U.S. stocks as investors evaluated a key inflation data that the Fed favors. The tech-heavy Nasdaq Composite had gained 47 points, or 0.3%, the benchmark S&P 500 had increased 17 points, or 0.3%, and the 30-stock Dow Jones Industrial Average had increased 200 points, or 0.5%, by 10:22 ET (15:22 GMT). The previous session saw a decline in the major averages, with Nvidia (NASDAQ:NVDA) leading the way with an 8.5% decline that erased $274 billion from its market worth. Fresh tariff comments from U.S. President Donald Trump, who announced that previously postponed duties on Canada and Mexico would take effect on March 4 in addition to an additional 10% duty on Chinese imports, also shook sentiment.

For more rate reduction, more proof of disinflation progress is required.

According to the minutes of the Federal Reserve’s January meeting, which were released Wednesday, policymakers favored a wait-and-see approach regarding additional rate cuts, citing the need for additional proof that inflation is slowing at a time when the economy is still strong and concerns about the inflationary impact of tariffs threaten to reverse the central bank’s progress toward the 2% inflation target. “Many participants, however, emphasized that additional evidence of continued disinflation would be needed to support the view that inflation was returning sustainably to 2 percent,” according to Fed minutes. The Federal Open Market Committee, or FOMC, maintained its benchmark rate between 4.25% and 4.5% at the end of its January meeting. Expectations for a protracted Fed pause have been heightened since the Fed meeting by incoming economic data, comments from Fed chair Jerome Powell, and a plethora of economic data, including inflation and hotter jobs. Participants noted that “the Committee was well positioned to take time to assess the evolving outlook for economic activity, the labor market, and inflation, with the vast majority pointing to a still-restrictive policy stance.” Fed members agreed with the call for a protracted pause. The Fed doesn’t need “to be in a hurry” to cut interest rates because monetary policy is already less restrictive and the economy is still doing well, Powell told the Senate Banking Committee earlier this month. Powell stated, “We do not need to adjust our policy stance because it is now significantly less restrictive than it was and the economy is still strong.”

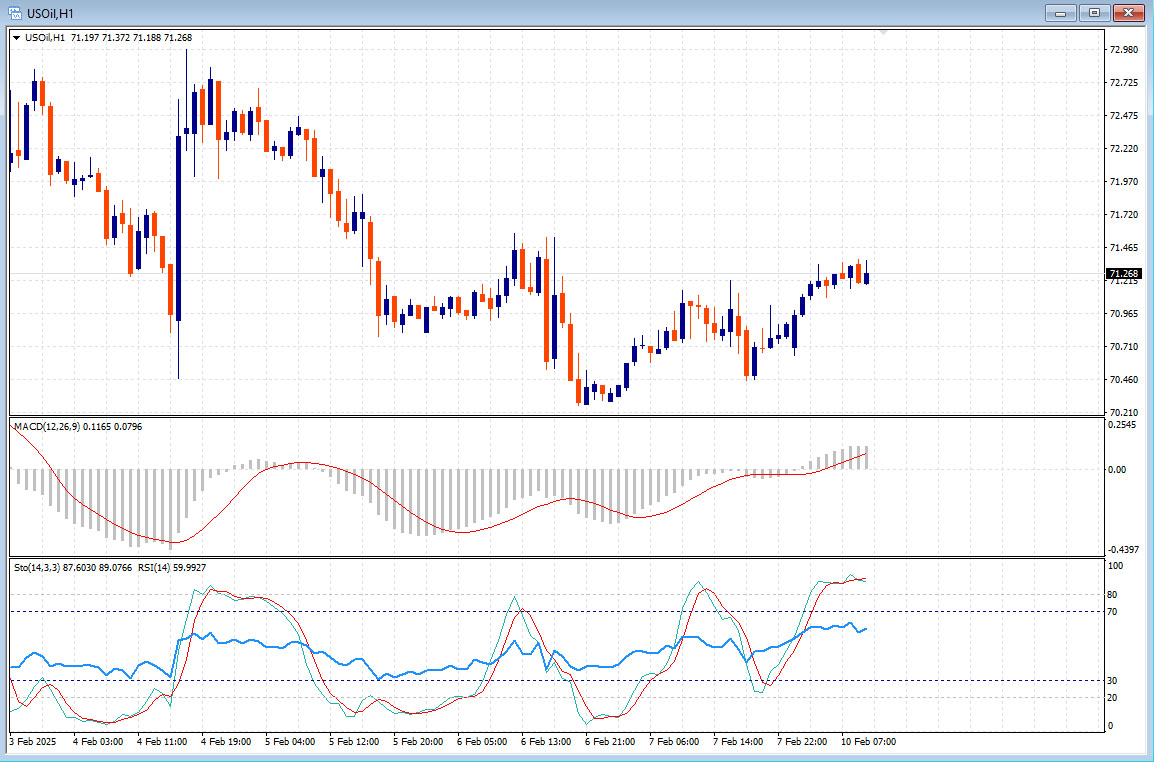

Oil climbs as investors weigh new US tariffs

While investors considered U.S. President Donald Trump’s most recent tariff threat, this time on all imports of steel and aluminum, which might impede global economic development and energy consumption, oil prices increased little on Monday. By 0734 GMT, U.S. West Texas Intermediate crude was up 50 cents, or 0.7%, to $71.50 a barrel, while Brent crude futures had increased 54 cents, or 0.7%, to $75.20 a barrel. Last week, worries over a global trade war caused the market to register its third straight weekly fall. Trump stated that, as part of a significant expansion of his trade policy reform, he will impose 25% tariffs on all steel and aluminum imports into the United States on Monday. Only a week ago, the president declared tariffs on China, Canada, and Mexico, but the following day, he halted them for the neighboring nations. According to Tony Sycamore, an analyst at IG headquartered in Sydney, investors seemed to be ignoring the steel and aluminum tariff threat for the time being following Trump’s brief concession last week. He stated, “The market has realized tariff headlines are likely to continue in the weeks and months ahead,” but he also acknowledged that there was a potential they would be lifted or even raised soon. “So perhaps investors are coming to the conclusion it’s not the best course of action to react to every headline negatively.” With little indication that Beijing and Washington are making headway, China’s retaliatory tariffs on a number of U.S. products are scheduled to go into effect on Monday.

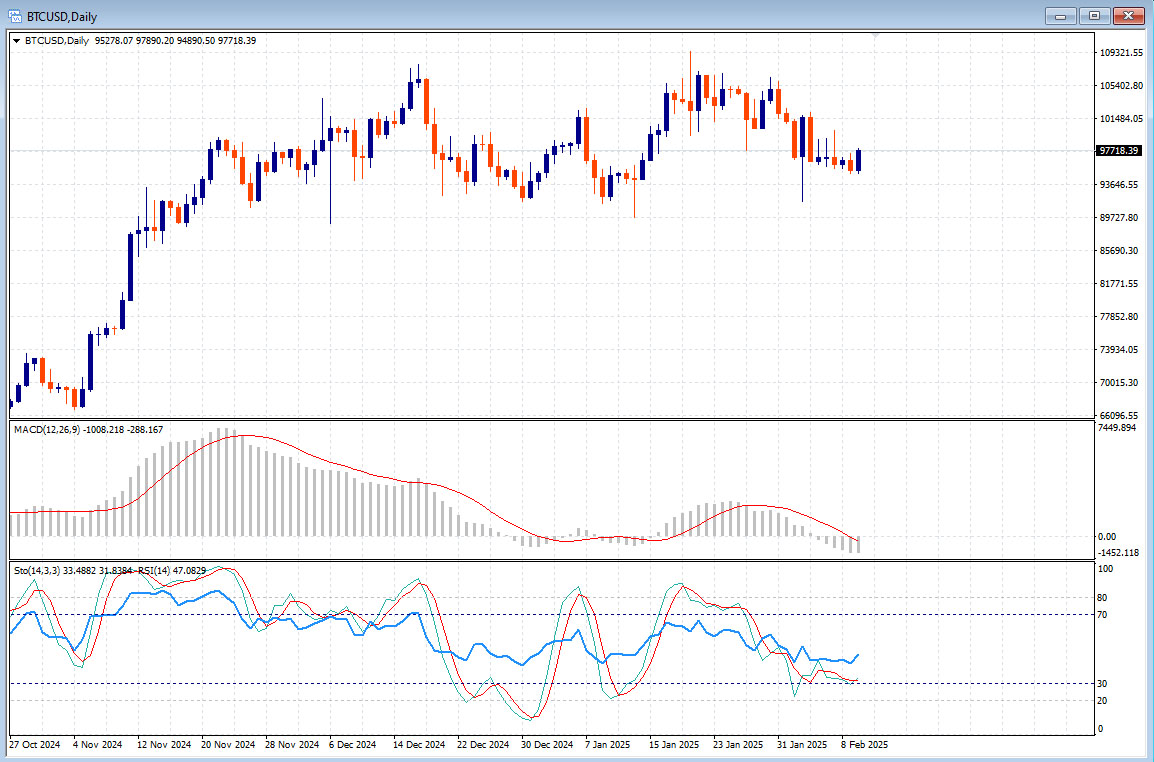

Bitcoin price today: muted at $97k amid new Trump tariffs, inflation jitters

Following a steep decline over the weekend due to heightened risk aversion following U.S. President Donald Trump’s new trade tariffs and traders’ caution ahead of important inflation data, Bitcoin was essentially unchanged on Monday. By 01:54 ET (06:54 GMT), the biggest cryptocurrency in the world was up 0.1% at $97,114.6. Last week, Bitcoin saw a nearly 4% decline as investors shunned speculative assets like cryptocurrency due to growing liquidity concerns brought on by the U.S.-China trade war. Crypto was also under pressure from the possibility of sticky U.S. inflation and high-for-longer U.S. interest rates, which significantly countered hopes for more lenient regulations under Trump.

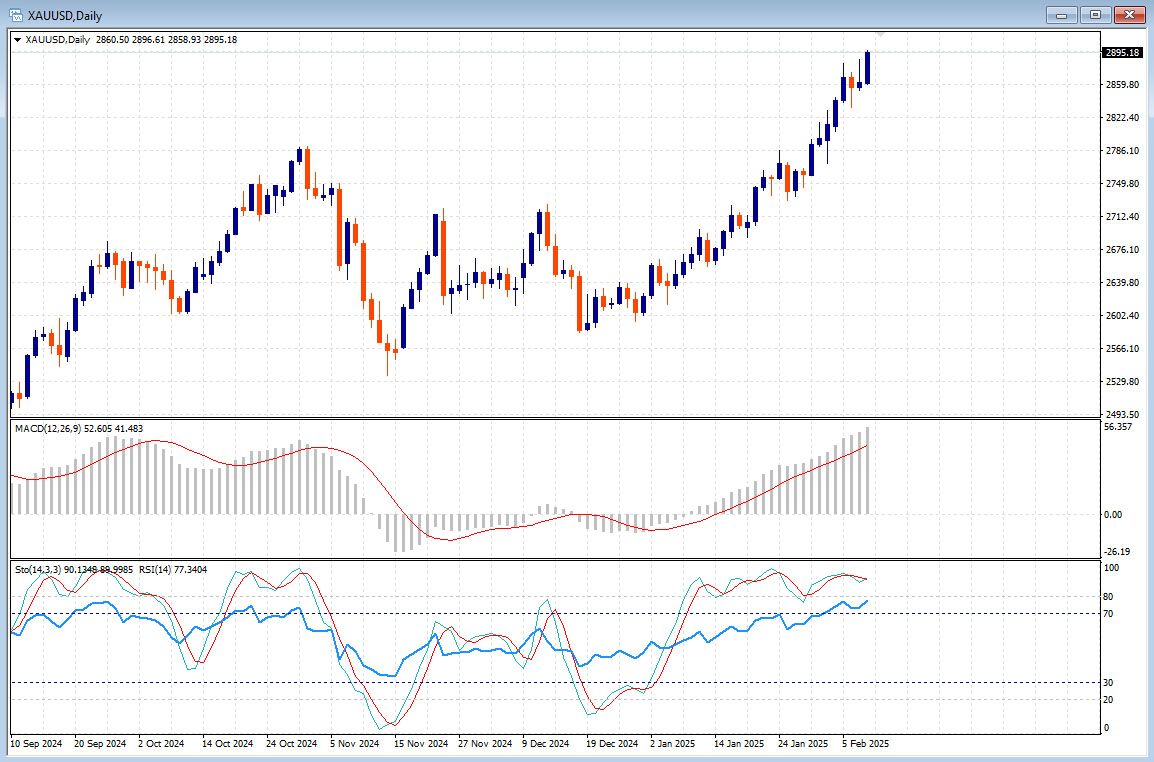

Gold hits all-time high amid Trump’s new tariffs

President Donald Trump of the United States slapped a new 25% global tariff on all imports of steel and aluminum on Monday, which caused the price of gold to hit a new all-time high. At 1:48 am ET, gold increased 1.12% to sell for $2,892.20 an ounce, while silver increased 0.60% to sell for $32.05 an ounce. Palladium had a 0.04% boost, selling for $963.47 at 1:55 am ET, while platinum saw a 0.30% increase, selling for $985.33 per ounce at 1:54 am ET.

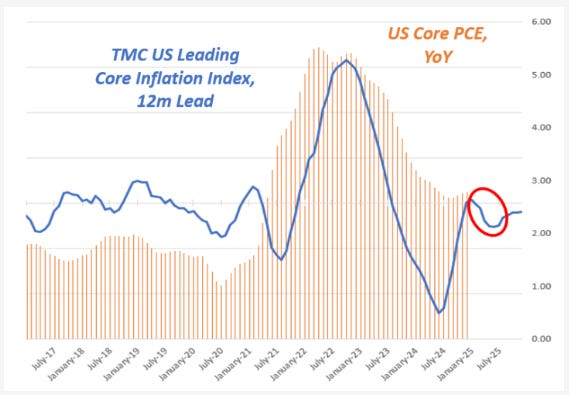

Could the Market Have Mispriced Inflation Odds?

For the first half of 2025, our primary macro thesis is that the US will experience another wave of deflation. In H1 2025, we anticipate core PCE to annualize at or below 2%. According to our Leading Inflation Indicator, a final wave of deflation may be imminent in the first half of 2025: The seven most statistically significant forward-looking indicators for core US inflation are used to construct this Leading Inflation Indicator in order to give it some substance. Leading indications of shelter inflation, which account for more than 30% of the core US inflation indices, are mostly to blame for the most recent decline. As you are aware, because of its approach, official shelter inflation sometimes takes into account on-the-ground rent growth with a delay. To forecast where shelter inflation will go, series such as the Zillow Rent Index have been utilized. One of the strongest indicators of shelter inflation is the CoreLogic single-family rent index, which just printed at its lowest level in 14 years: Other leading indicators also show that the housing sector is beginning to show signs of weakening. The massive backlog to clear was a major factor in the property market’s resilience in the face of high mortgage rates. The demand for housing was extremely high during the epidemic, but labor shortages and supply constraints prolonged the building construction cycle, resulting in significant backlogs that kept the housing market afloat. This tailwind appears to be expended, as major US homebuilders such as D.R. Horton are now claiming that their backlogs have returned to 2019 levels: Furthermore, the construction industry’s job opportunities are rapidly declining, according to Tuesday’s JOLTS report (see figure below). A cyclical downturn in the construction industry has historically been an early indicator of a broader softening in US growth conditions because the industry is essential to the US business cycle. To be clear, there are now no layoffs among construction workers. However, it appears that the circumstances are favorable for a downturn in the housing industry, which also causes disinflation through the component of rent for shelter: A disinflationary slowdown in growth may be imminent, according to new data on inflation, growth, and the housing market. The Fed could then swiftly re-establish the Fed Put and move to a quarterly rate of cuts. Stocks and bonds would rise as a result of this “proactive risk management” dovish posture, which would improve financial conditions. The Fed is expected to put itself on pause in March, make perhaps two cuts this year, and then essentially stop there. The Fed’s reduction cycle ends at the terminal rate, which is priced at about 3.90%. Bonds have an intriguing risk/reward ratio if my disinflationary thesis is proven to be accurate, since the likelihood of Fed raises is minimal as long as Powell serves as Fed Chair until May 2026. Thank you for reading, and that’s all for today.