Every field has its own verbiage that is used. The same words can mean something different, depending on where it is being used. With that said, there are common terms used in the forex world. If you are well-acquainted with the subject, the following definitions are most likely already familiar to you. This list is not exhaustive as the forex market and traders have and use their own vocabulary. However, if you are new to being a trader, the following terms and definitions will help you navigate the game when you are in it: Base and Counter Currencies: In forex markets, traders are continuously and simultaneously buying and selling currencies. In other words, traders are consistently exchanging one currency for another. For that reason, the prices of currencies are inevitably quoted in pairs. The way the prices are written reflects the unit of the first currency that a person is willing to pay for the other currency. The first currency listed is the base currency, whereas the second currency mentioned is the counter currency. An example of this is USD/EUR. The first one is United State Dollar, which is the base currency, and the second one is Euro, which is the counter currency. Long and Short Positions: Traders are permitted to take long and short positions. Going long means that a trader will buy units of the base currency and sell units of the counter currency. For example, if a trader is going to go long on the USD/EUR pair, then he or she must buy the USD and sell EUR in the marketplace. Alongside long positions, short positions mean that a trader will sell units of the base currency, simultaneously buying units of the counter currency. With that said, if a trader is going to go short on the USD/EUR currency pair, then he or she must sell the United States Dollar concurrently with buying the EUR. As a bonus, it is important to note that there is something called squaring off. Squaring off means that one is going back to a zero position from a short or long position. If a trader intends to square off in a long position, he or she would have to sell; on the other hand, if a trader intends to square off in a short position, he or she would have to buy. Bid, Ask, and Spread: Because currencies are in a pair with forex trading, the price at which one is willing to buy is typically always less than the price at which one is willing to sell. The difference in price is there to help compensate traders for the risk they endure by maintaining a volatile asset for an unpredicted period of time. The bid price is the price at which market makers are willing to buy and ask price is the price market makers are willing to sell. The difference between the two is often referred to as the spread. Lots: In the Forex market, a lot is a standard unit of measurement for currency trades. One lot is equal to 100,000 units of base currency in a forex trade. For example, if you are buying the EUR/USD pair, and you place an order for one lot, you are effectively buying 100,000 euros. The size of a lot in forex can vary depending on the specific brokerage or platform, but most retail forex brokers offer the option to trade in lots that are much smaller than 100,000 units of base currency. You are also able to choose between micro-lots, which are worth 10,000 units of the base currency or nano lots which are worth 1,000 units of the base currency. This allows the traders to trade in smaller increments and to more effectively manage risk.On our server, TradersGlobalGroup, we have a standard lot of 100,000 units. Pip: The minimum amount of money that a currency quote can move is called a pip. Generally, a pip refers to 1/10000 of the quoted currency. In other words, a currency must deviate by approximately 0.00001 in order for there to be an impact on the quoted prices in the market. This term has become of regular use to traders in that changes in prices and often time profits are conveyed in terms of pips. Because there may be varying definitions of this term, traders who are a little more experienced in the field are able to communicate using the word more accurately. Value Dates and Rollovers: The dates when the parties involved in the trade agree to settle their accounts is the value date. All open positions of all derivative contracts close mechanically on the value date. Because accounts close automatically on the value date, contracts become more volatile closer to the time. There are times when traders decide to rollover their contracts. In simple words, this means that traders determine that they will settle their contracts on the next value date instead of the current one. If this is what they want to do, both parties must agree and pay a fee based on the interest rate differenital of both currencies involved.

How to Trade with the Fibonacci Retracement Tool

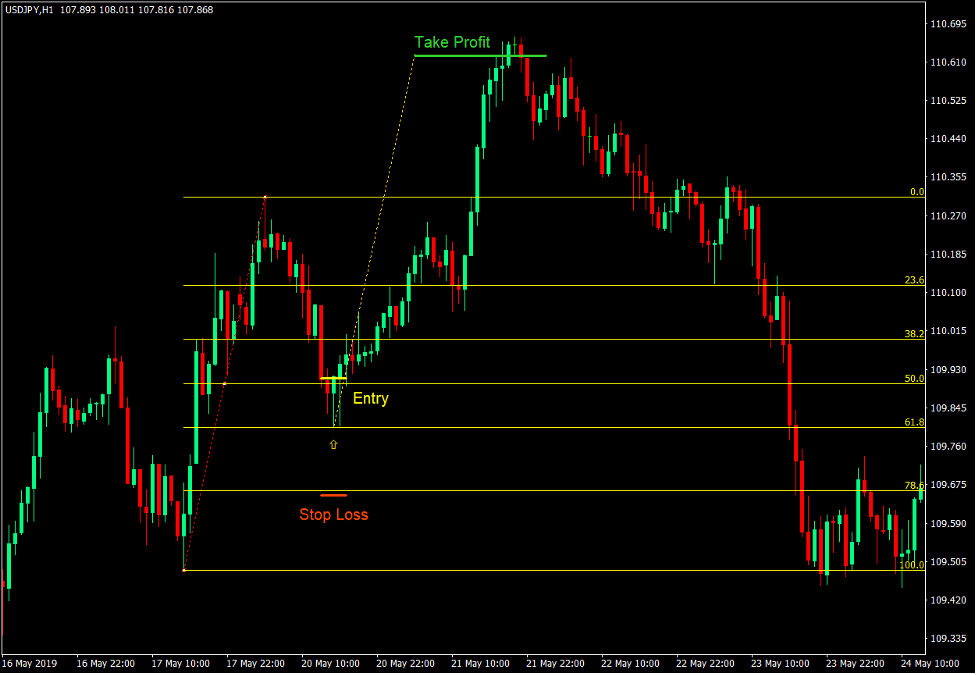

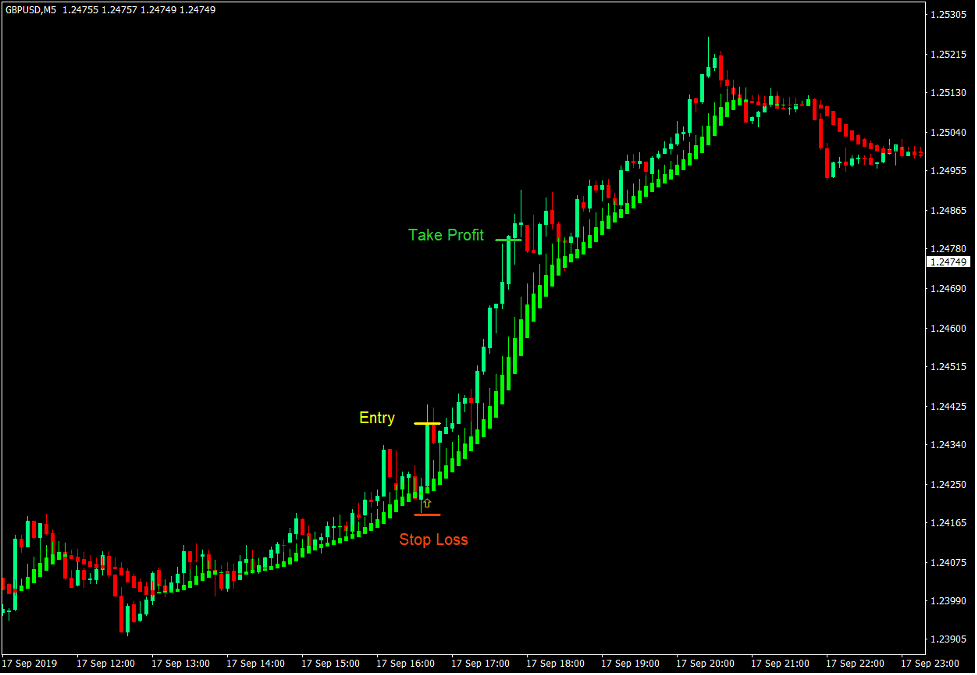

Traders are often on the look out for tools that would give them a trading edge. It may be an indicator, a charting tool, a trading strategy, basically anything that would give them an advantage over most traders in the market. For the most part, traders would often look for something novel in the hopes that their unique tool would give them the advantage they are looking for. However, most would forget that what matters most is that they have a tool that works. The Fibonacci Retracement tool is a basic trading tool which is found on all MT4 platforms, as well as other trading and charting platforms. In spite its being a basic tool, it is however very effective. Professional traders use them. Profitable traders use them. Big bank institutional traders use them. It would be a good idea if we would also discover what it is and how to use it effectively. Fibonacci Sequence and the Fibonacci Ratio The Fibonacci Sequence is was discovered by Leonardo of Pisa, also known as Fibonacci. Fibonacci was a mathematician who first studied with the Arabs and later on introduced algebra to Europe. Along with algebra, he also brought with him his observation of the Fibonacci Sequence. The Fibonacci Sequence is a series of numbers which has a core logic based on the addition of two sequential sums starting from 1. Starting from 1, the Fibonacci Sequence is as follows: 1 + 1 = 2, 1 + 2 = 3, 2 + 3 = 5, 3 + 5 = 8, 5 + 8 = 13, 8 + 13 = 21, 13 + 21 = 34, 21 + 34 = 55, 34 + 55 = 89, 55 + 89 = 144, 89 + 144 = 233, and so on up to infinity. If you would observe the sequence closely, you would see that there are recurring patterns that can be found as you go along the sequence. This becomes apparent as the figures increase. For example, if you would divide the first addend by the second addend, you would note that the quotient is usually around 0.618. This means that the first addend is always 61.8% of the second addend. Inversely, the difference between the two addends would always be 38.2%. If you would also divide the sum by the second addend, the result would always be close to 1.618, meaning that the sum is always close to 161.8% of the second addend. We could also note that the sum is always close to 261.8% of the first addend. These percentage patterns, 38.2%, 61.8%, 161.8% and 261.8%, form the basic Fibonacci Ratios, with the ratio of 61.8% being the “Golden Ratio”. There are many more mathematical patterns that could be observed in this sequence. However, these percentages are the most basic Fibonacci Ratios. These ratios may not be interesting mathematically. What makes it more interesting is that these patterns are also recurring ratios in nature, be it the helix of a shell, the veins of a leaf, the human limbs or a fractal of a snowflake. What makes it even more interesting is that these same Fibonacci Ratio patterns have also been discovered by traders to be recurring ratios in a technical price chart. Fibonacci Ratios and the DiNapoli Levels Joe DiNapoli included the Fibonacci Ratios as one of the bases for a DiNapoli Level in his book “Trading with DiNapoli Levels: The Practical Application of Fibonacci Analysis to Investment Markets”. DiNapoli Levels are basically levels in which price typically bounce from. In his book, Joe DiNapoli outlined how price tends to bounce off certain Fibonacci Ratio levels based on swing points. He introduced there the idea that price tends to bounce off the 61.8% price point of the length of a price swing during trending markets. This 61.8% ratio has been known as the “Golden Ratio”. He noted that price typically bounces off 61.8% and would rarely reach 78.6%, which is one of the more intricate Fibonacci percentage ratios. He also noted that price would typically move in the direction of the trend usually by the same length as the prior price swing or 100%, 138.2%, or 161.8%. As such, his main trading strategy was to enter the market at 61.8% of the price swing, set a stop loss at 78.6%, and take profit at 100%, 138.2% or 161.8%. He also added levels 50% and 38.2% as potential points where price could also bounce off making it a valid entry level.

Discover the Most Valuable Currencies in the World

There are several factors to consider when it comes to determining the value of a currency. These include the stability of the country’s political climate, the strength of its economy, and the overall demand for that currency on the global market.

One way to measure the relative value of a currency is by looking at its exchange rate against the US dollar. The US dollar is considered the world’s “reserve currency,” meaning that it is widely accepted and used in international trade and finance. As such, the exchange rate between a country’s currency and the US dollar can indicate its relative value.

Another way to measure the value of a currency is through its purchasing power. This considers the cost of goods and services in each country and compares it to the cost of the same goods and services in other countries. A currency with a higher purchasing power is considered more valuable than one with a lower purchasing power.

When we look at the most valuable currencies in the world based on these metrics, the ranking may surprise you.

The Swiss Franc: The Most Valuable Currency in the World

The Swiss franc is the most valuable currency in the world, according to the International Monetary Fund (IMF). The main reason is Switzerland’s strong and stable economy and its reputation as a haven for investors. Now, the exchange rate between the Swiss franc and the US dollar is 0.93, meaning that one Swiss franc is worth slightly more than one US dollar. Additionally, Switzerland has one of the highest purchasing powers in the world, with a cost of living that is among the highest in the world. Some other factors the Swiss franc is considered a safe investment also are:

– Its long-term value is tied to the long-term strength and stability of the country’s economy.

– Switzerland has a great history of hard assets, including gold reserves. Investors know that the Swiss franc is tied to hard assets.

– The Swiss franc’s strong GDP, lack of a budget deficit, low unemployment, high per capita income, and status as a destination for cash through hidden bank accounts.

The US Dollar: A Close Second

The US dollar is the second most valuable currency in the world, due to the strength and stability of the American economy. The US dollar is widely accepted and used in international trade and finance, and its exchange rate against other currencies is closely watched by investors and economists. As mentioned before, the exchange rate between the US dollar and the Swiss franc is 1.08, meaning that one US dollar is worth slightly less than one Swiss franc, as of January 2023.

Other Valuable Currencies

Other currencies that rank highly in terms of value include the Euro (EUR), the Japanese Yen (JPY), and the Canadian Dollar (CAD). Each of these currencies is backed by a strong and stable economy, and their exchange rates against the US dollar are relatively favorable.

Conclusion

The Swiss franc currently holds the title of the world’s most valuable currency, due to its stable economy and reputation as a haven for investors. The US dollar, Euro, Japanese Yen, and Canadian Dollar also rank highly in terms of value.

It is important to note that currency values are in constant fluctuation and subject to change, so staying informed about the latest developments in the global economy and currency markets is crucial.

Happy trading

How to Trade with Heiken Ashi Support and Resistance

Markets based on tradeable instruments such as stocks, bonds, forex, cryptocurrencies and commodities may sound very sophisticated. It may be because of those movies showing how

Control What You Can; Let Go of What You Cannot

It is important to understand the difference between what you, as a forex funded trader, can and cannot control. Successful traders are well aware of what is in

A Trader’s Routine

Mike Murdock said, “the secret of your future is hidden in your daily routine.” This holds true in the forex trading world as well. We understand that every individual is unique with different routines and habits, but we would like to point out some habits that you can add to your routine that may ultimately help improve your trading ways in the long run. Today, we live in a world where we are always racing against time. For example, (and of course, this is not true for everyone) people are typically busy checking their smartphones every few seconds, often compromising on their sleep and dietary habits because they are too caught up in the social networking world. We find that in the trading world, beginners find themselves in a habit of forfeiting sleep because they are in a state of confusion or frustration for one reason or another. If your habits and routine work for you, please continue to do what you do – you know yourself best! If you are looking for a good routine, we have compiled a list of things to do to improve your routine. The information we provide below is by no means exhaustive and can be changed and altered to each individual’s needs. You may find some information below to be something you have come across at various stages of life, but that is probably because things that make a good routine in any realm tend to be the same in nature!

One: Sleep well! It’s easy to get caught up with the things that peak our interest and things that we are invested in. If you are here, you are most likely interested in and invested in forex trading. We believe that successful traders do not compromise on sleep. We cannot stress the importance of sleep! Don’t fall into the pattern of sleeping less than recommended hours of sleep (which is typically between six to eight hours each night) with caffeine or other methods to energize. Continuous reliance on such will eventually catch up with you and compromise your ability to be strategic when it comes to trading. As you are well aware, forex trading requires attention, alertness, and much more. Lack of sleep will compromise your ability to do any of the aforementioned things well, which may lead to poor decision-making with forex trading. Two: You are what you eat! Okay, just kidding. Some people are not adamant about having a good, healthy breakfast. This is something that should not be taken lightly, and you should make an intentional effort every day to consume a healthy breakfast. And we are sure you hear this all the time but drink a lot of water! If your body is functioning the way it is supposed to, then your brain will inevitably work to its fullest capabilities. You may think this is a bit of a stretch, but naturally, the better your brain and body are functioning, the better your chances of making reasonable decisions that bring in profits (hopefully) for you while trading.

Three: Exercise, exercise, exercise. Forex trading does not require physical labor. If you are seated for long hours in a day, you should make a routine involving exercise. We all know and have heard all the benefits of exercising, but unless we discipline ourselves well, this habit can easily and quickly fall through the cracks. Simply put, trading can be mentally exhausting for many of us, and exercise is therapy. Four: While nothing wrong with it, be more than just a forex trader. Now, before you get upset, what we mean by more than just being a trader is to ensure that you have other hobbies and a healthy social life. You do not want to be the person who is constantly in his or her room all day and avoids life and people just because you are consumed by trading. Hobbies vary from person to person, so maybe you like reading and writing in your downtime, or maybe you like to travel or watch movies. Regardless of what hobbies you hold, it is important to have time to enjoy life and do things you love, all while being a trader.

Five: A goal without a plan is just a wish. Having strategies and a good plan in place will serve you in many aspects of your life; the trading industry is no stranger to this. When you, as a trader, plan out the week in advance, you will find that you will be ahead of the game. Six: Often, positive thoughts breed positive results. Traders can often find themselves feeling frustrated, confused, and/or mentally defeated. This holds true for many beginners and even those who are experts at trading. With that said, a positive mindset is necessary and important to stick to a trading routine. It all beings with positivity. If something does not seem to work for you immediately, be patient and give your strategies and plans some time before reevaluating what needs to be changed. If you ever find yourself in a mental place that is not serving you, it is important to redirect your mind to positive thoughts and keep pushing forward. Seven: You are not alone. It is always important to remember that you are not the only trader and others may be experiencing similarly as you. 8FigureTrader team is diligent in being there for people with questions and concerns. We aim to get back to you as soon as possible and discuss whatever it may be that you want and need to be addressed. Additionally, we are a community, and we treat our traders as a family. Never feel bad about reaching out and asking questions, whether that means that you reach out to us, or someone else who is also in the business of being a trader. Learning the strategies, goals, and mindsets of other traders can help you get to where you want to be. Mistakes can be avoided by speaking to experienced traders who have gone through the good and bad of the forex market. Irrespective of what you choose, you should always remember that there are others alike who can help you on your journey!