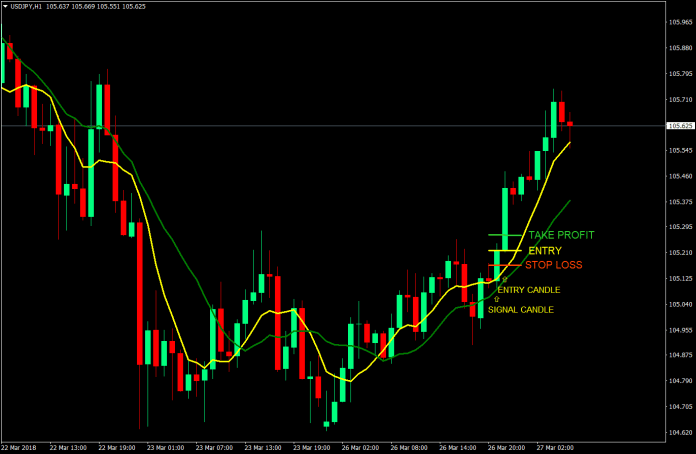

At the beginning of a new candle, there is often a few minutes wherein price don’t seem to move much. This is because many astute traders know that as a candle forms, other traders would make decisions based on the type of candle that was formed. No one would know what would happen next. Price may either continue the direction of the previous candle, or it may reverse. This few minutes window of indecision by the market is called consolidation. Many scalpers in slower moving markets use the Depth of Market window or what others call Level 2 order flows to get a feel for where the market might be heading next. However, I seldom find traders who use Depth of Market in forex trading. There may be several reasons for this. For one, there are very few trading platforms that give the complete picture of pending orders based on the Level 2. Another reason might be because of the sheer size and volume of transactions in the forex market, pending orders on both sides are too big, information regarding the pending order’s volume move so fast, it humans couldn’t cope with the speed. Sadly, I think we don’t have a way to assess the direction using the consolidation phase every candle open. But all is not lost. What we can do however is trade ignored consolidations. There are times when the market seems to skip the consolidation phase every candle opening and continue the direction of the previous candle. This is called momentum. Momentum plays is one of the most common types of strategies, with varying approaches and styles. The idea behind this is that the force behind the previous candle is so strong, the market would just push through with its current direction. With this strategy, we will be trading candles that we believe have momentum and that the next candle would ignore consolidation. To do this, we will be using 7 & 14 Simple Moving Averages (SMA). We will also be targeting only five (5) pips. If the candle really does have momentum, a 5-pip target would be easy. The Setup: Trading Momentum Using 7 & 14 SMA Although this is a scalping strategy, we will still be using the 1-hour timeframe. This is because more traders are looking at the hourly candles as compared to the lower timeframes. If the previous hour does have momentum, traders looking at the candle on the next hour would immediately enter based on candle patterns without waiting on the consolidation phase. This volume of traders would push momentum further. The rules of this strategy will be based on how a candle opens and closes in relation to the 7 & 14 SMAs. Buy Setup: The 7 SMA should be above the 14 SMA. On the signal candle price should open in between the 7 SMA and the 14 SMA. On the same candle price should close above the 7 SMA. There should only be a little to no wick above the signal candle. The low of the candle should not go below the 14 SMA. Enter immediately at the open of the next candle. Stop Loss: Stop loss should be 5 pips below the entry price. Take Profit: Target take profit price should be 5 pips from entry price.

Ways to Expand and Diversify Forex Trading Portfolio

COVID-19 has touched people’s lives in ways that nothing has before. Recently, hundreds of thousands of people began their trading journey during the pandemic for the very first time. Without knowing what you are getting into, the chances of losing or breaking even are high; this is why we recommend that you educate yourself in the field before beginning your funded journey. 8FigureTrader (8FT) takes great pride in helping facilitate ways for funded traders to get into the game. One of the best ways to magnify your staying power and establish a profitable and sustainable long-term plan is to invest in several areas of the market. Using different strategies may minimize the chances of one drop affecting your portfolio as a whole.

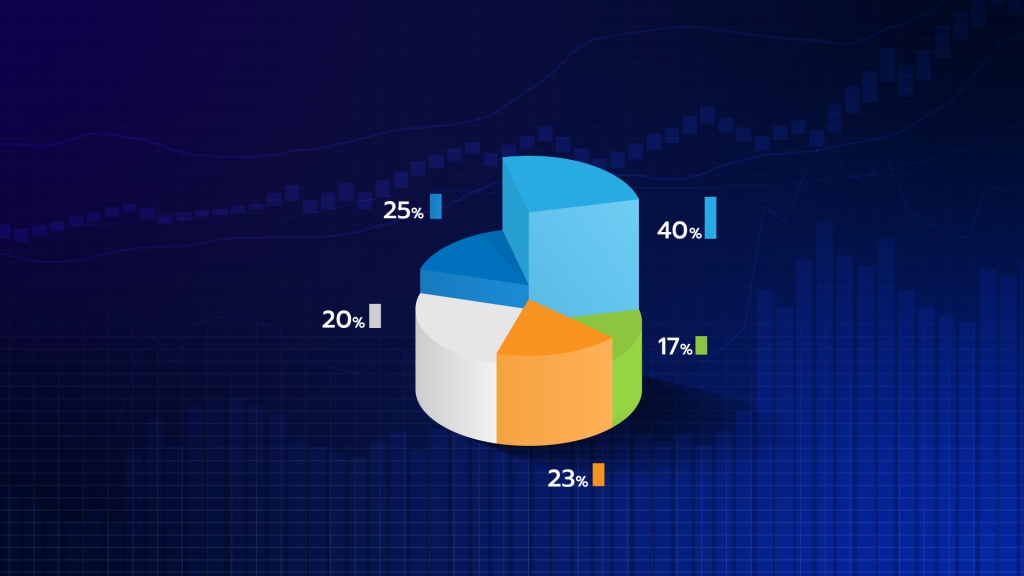

There is a saying that we all are aware of that goes something like, “don’t put all your eggs in one basket.” If a trader spreads his or her investments across different assets that are ultimately influenced by different factors, he or she may decrease chances of exposure to “unsystematic risk,” which in other words, means that the trader won’t risk it all if something goes downhill with one investment. By nature of the way trading works, it is highly unlikely that you can avoid all risks, but there are strategies that you can have in place that will minimize the risk of losing it all, which will then in turn increase the chances of winning into the future. Additionally, having a diverse forex portfolio will give you an opportunity to experiment with trades, improving the chances of coming across favorable outcomes and making a profit.

There are many ways to diversify your trading. One of the ways is to use a mix of currency pairs. Doing this will enable you to diversify the ways in which you spread risk using different currency pairs with various levels of risks attached; this will then in turn give you the opportunity to save yourself from major losses. For example, you could use a base of major currency pairs that are less volatile, such as GBP/USD, AUD/USD, or EUR/USD. In addition to that, you could then add some minor unique pairs, such as EUR/TRY. The unique pair is more volatile and creates a sizeable opportunity for large profits. However, it is important to note that unique currency pairs like the aforementioned also mean there are bigger opportunities for large losses.

Another way to diversify your trading portfolio is to learn different strategies. Mixing up strategies will give you a sense of the strategies that are the most beneficial for you and the ones that generate the most returns.

Lastly, experiment with trading times. Depending on the time and day, currencies perform differently. It is important, if not crucial, to monitor the ways in which currencies function depending on the time. Doing so can provide you with new opportunities. Of course, you will always have to consider the risks involved.

Diversifying your portfolio will give you an extended opportunity to tip the odds in your favor, bringing in more profit than bring about losses. The better you get at this with time, the more you will learn how to diversify your portfolio and make more money (and minimize losses).